A study of delegation.

A study of delegation.

The Nouns DAO model is introducing a new era of experimentation in governance. Its principle is straightforward: organize around a core meme, represented by an NFT, where one is sold each day in an auction, funds generated are deposited into a treasury controlled by the holders of these NFTs. One NFT equates to one vote, and owning two grants the ability to propose any spending from the current $40M in the treasury. Proposals are voted on based on their perceived impact on furthering the meme.

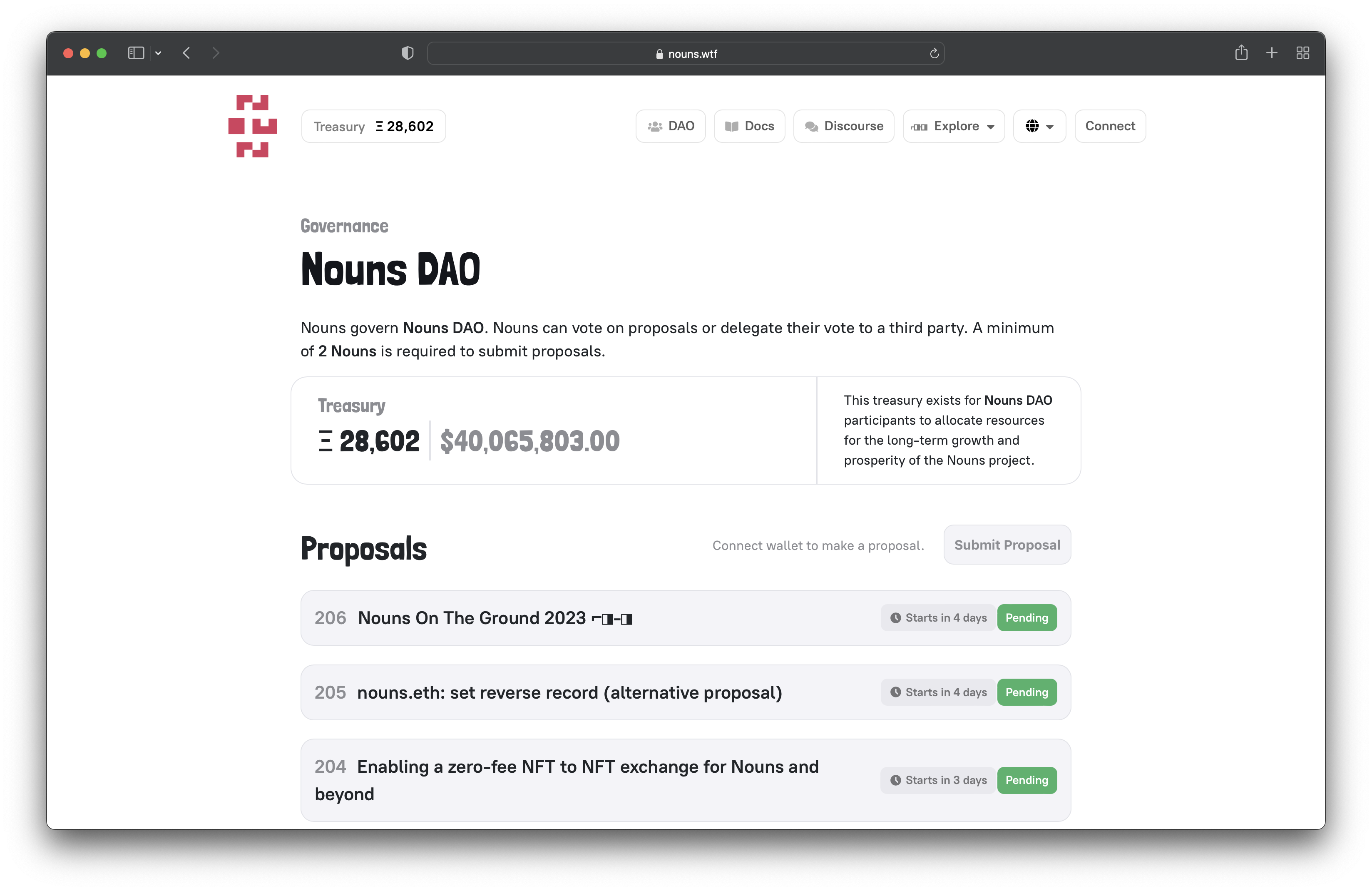

A screenshot of the Nouns DAO voting interface.

A screenshot of the Nouns DAO voting interface.

Nouns offers a distinct perspective on onchain governance, despite the fact that Compound Bravo has been in use for a while. By centering around a meme, the possibilities are vast in comparison to a traditional DeFi protocol. Instead of focusing on protocol variables and upgrades, the Nouns DAO has already implemented over 200 proposals and invested millions of ETH in a diverse range of initiatives, including the Rose Parade, naming newly discovered Toads, fashion collaborations, supporting extreme sports athletes and cleaning projects in Africa.

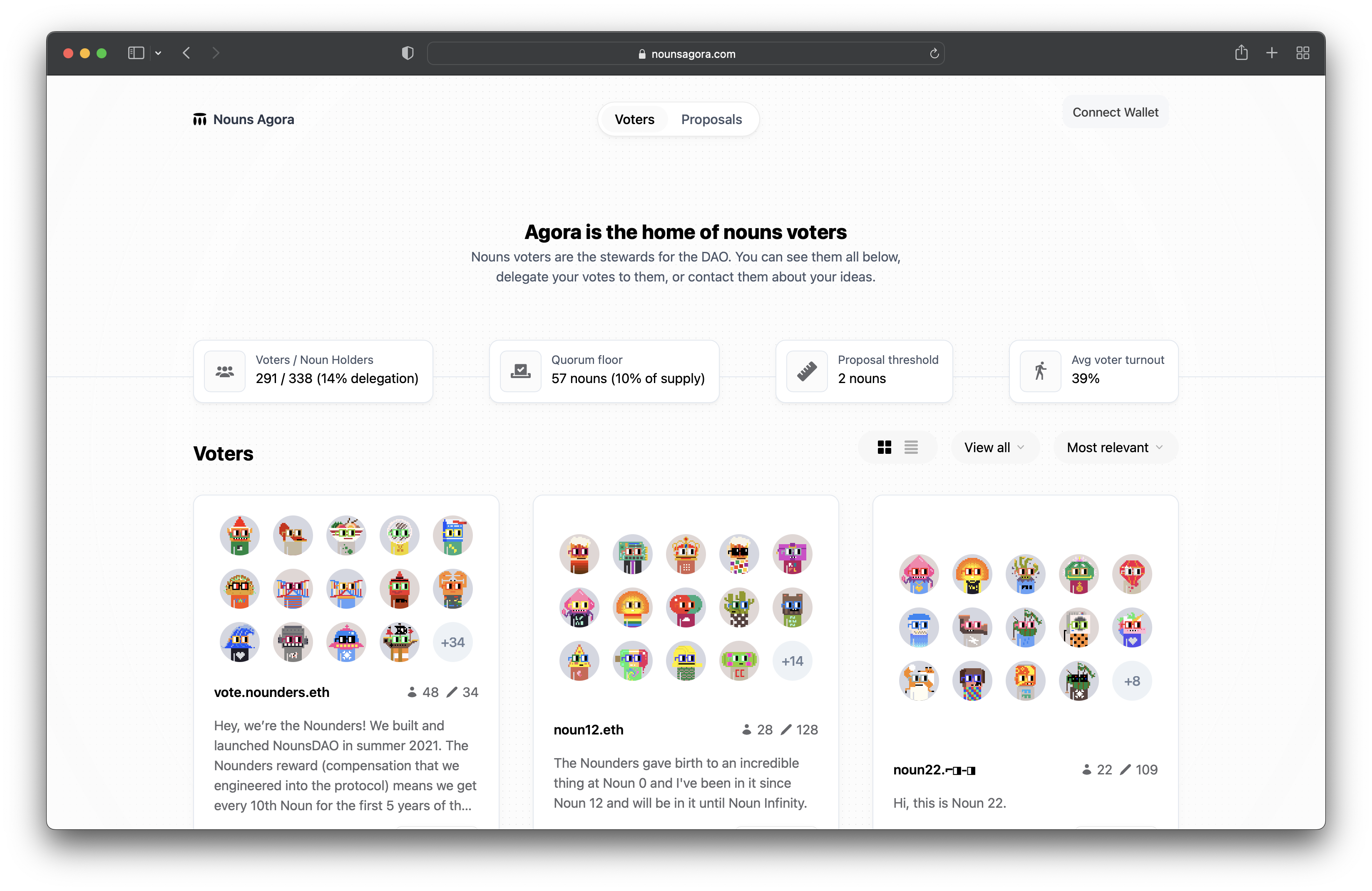

One important dimension to Nouns governance is the ability to delegate your vote. If a Noun owner doesn’t want to spend the time deciding on proposals, they can delegate that vote to someone else while still maintaining ownership of the Noun itself. This has led to multiple delegates ranging from 2 votes represented to 28 (~5% of supply), with 14% of Nouns being currently delegated. The average voter turnout is currently 39%.

Agora: a tool for Nouns delegation.

Agora: a tool for Nouns delegation.

The fact that voting is NFT mediated, occurring often, can be delegated and with low thresholds to propose means we have pretty fascinating conditions for experimentation with the nature of voting onchain. One experiment I want to put forward is Delegation Markets.

Definition

Delegation Markets

Delegation Markets are a public, transparent and permissionless way to buy and sell delegated votes for a defined period of time.

Why Delegation Markets are important

Given the level of capital at stake and the permissionless nature of Nouns governance, the incentives exist for people to pay to solicit the votes of Noun owners to vote yes on any given proposal that is onchain—we can call this Voter Extractable Value. At face value, the fact this incentive exists seems as terrifying as lobbying and bribery that we see in traditional governance systems, with all of the associated negative externalities that come with this activity. However, given the public and programmable nature of the blockchain we may have a case for optimism—and Flashbots and MEV might be a great working analogy to help illustrate that optimistic case for Delegation Markets.

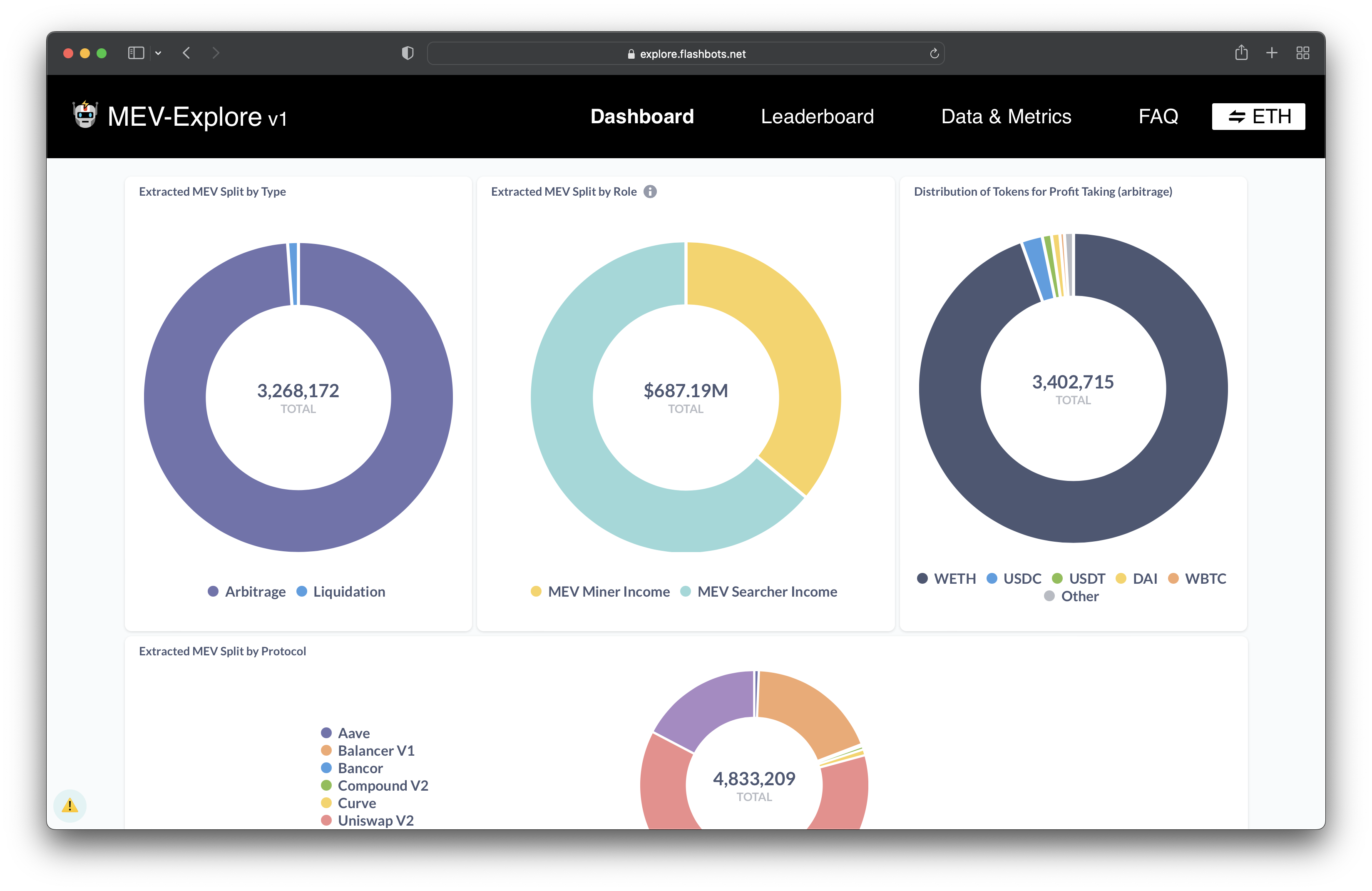

An explorer displaing MEV activity on Ethereum.

An explorer displaing MEV activity on Ethereum.

Miner Extractable Value (MEV) was once viewed as an existential risk to the block production incentives—actors started paying miners increasingly high gas prices to prioritize their transactions in arbitrage scenarios, leading to massively inflated gas prices for the entire user base. Instead of trying to thwart this activity, the philosophy of Flashbots instead created a new system that allowed these incentives to play out in a transparent, accessible and permissionless market. This removes the negative externalities of high gas prices for the entire network and allows for actors to participate in auctions for transaction priority.

Delegation Markets can be seen as a solution in the same vein as Flashbots. Instead of trying to thwart or ignore the bribery and solicitation that may happen behind closed doors, we can create a transparent, accessible and permissionless market to form around delegated votes. By creating a market for these votes, we might see an increase in vote utilization—given that passive holders could sell their votes for a period of time. This may also positively impact the value of a Noun, given there is now a separate and direct mechanism to capture the value of the vote at any given period of time without having to sell the Noun.

Some thoughts and questions that come to mind

- Will we see a new class of delegates emerge in the ecosystem that resemble activist investors we see in traditional public organizations?

- What will be the relationship beween the price of a vote, the DAOs current treasury and current value of proposals that are onchain?

- Will a market price for a vote cause owners to participate instead of selling, now that the value is more legible?

- What time horizons should be standardized for delegation? Longer time horizons should probably command a premium, but per proposal is possible and may be more common

- A market price on delegations will likely increase the demanded performance of delegates with large votes

- A market price on delegations may result in professional delegates being compensated for their proven performance

- Mispricings of delegated votes could lead to cheaper 51% attacks

- It seems hard to guess what % of total delegates will actually be sold

- Would it ever make sense for a DAO to buy it's own delegated votes

- Should the smart contract that executes this exchange hold the capital in escrow for the full term or payout per block?

- There should probably be a penalty paid for ending a delegation before the contract is up, assuming that functionality exists

What’s the value of a vote?

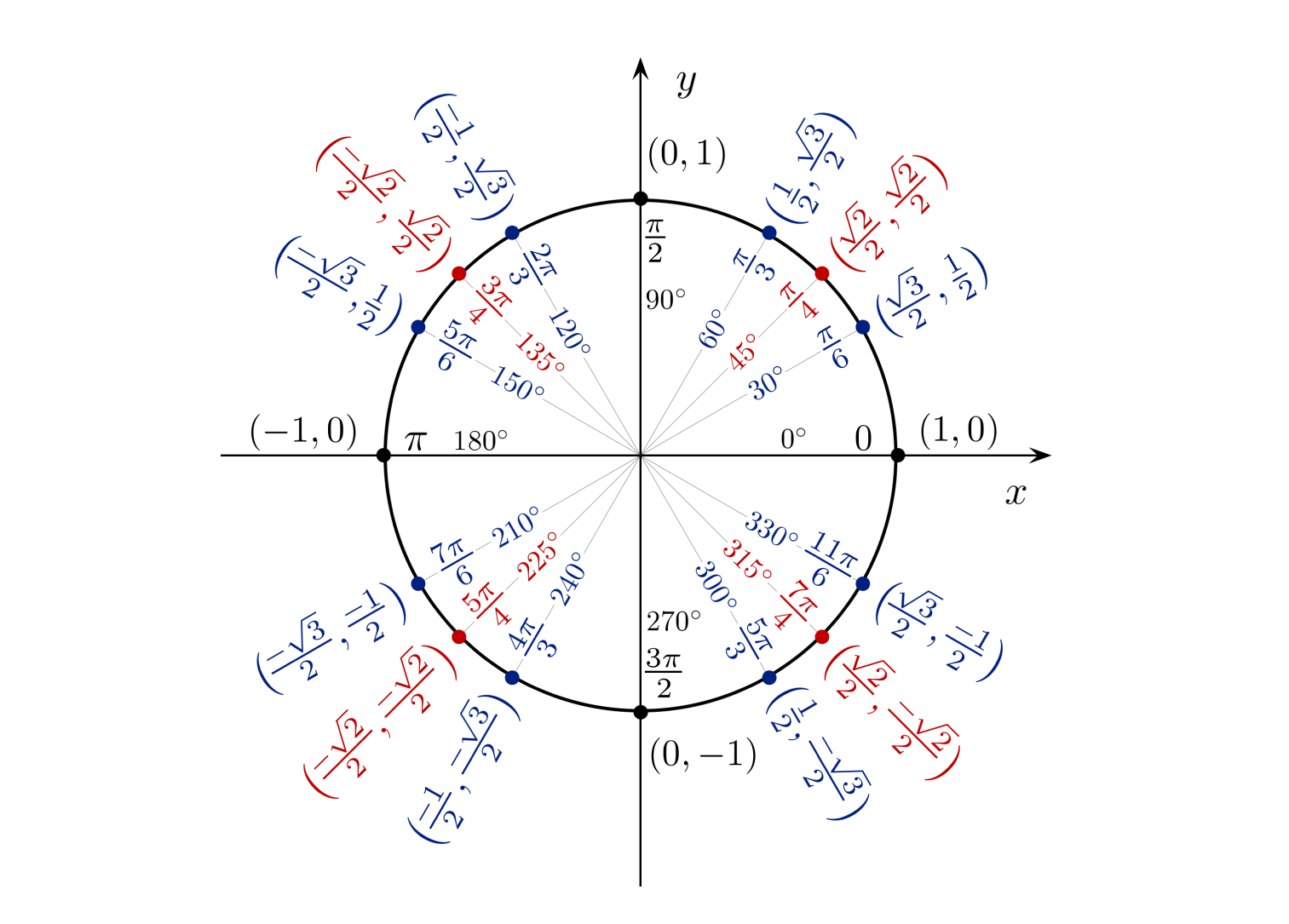

Unit circles are good.

Unit circles are good.

There is prior work in determining the relative value of governance tokens, which attempts to determine the value of a vote based on how often a vote will be decisive. I’m sure there is also a quantifiable formula that could be derived based on the given proposal amount and distribution of votes, and likely other working examples or studies—send them through to me.

In the meantime, let’s run a live experiment: check out this delegation auction, which is being run by Agora. Whoever wins the auction will be delegated one Noun vote for 3 months starting January 18, 2023.

The NFT being auctioned off for 3 months of delegation.

The NFT being auctioned off for 3 months of delegation.

Mint:

Shoutout to Yitong and the Agora team for running the first experiment.

❍ 2023 jacob