Using NFTs to predict the future.

Using NFTs to predict the future.

A limitation to prediction markets is that they are zero sum. This means that for every dollar won, there is someone losing that dollar on the other side—it is winner takes all.

This is a limitation because it means that if you want to make a prediction, you always need to find someone who wants to take that other side of the bet. This sucks for a couple of reasons: the first being that finding a counterparty is difficult, especially for the more obscure predictions. Secondly, you need to lock up that capital for the duration of the bet (capital inefficient). The result of both of these things is that price discovery is very difficult. If you’re looking to make a bet on something particularly niche or very out there—you’ll be hard pressed to make that bet even in the case that you might be right.

Equities do not have this issue, they are positive sum markets. When an entrepreneur is starting a company with a particular point of view (prediction) and goal in mind, they do not need to find someone who is actively betting against them to capitalize on this prediction. In fact they find someone who is actually looking for them to succeed. In the case they do succeed, the market then revalues the asset at hand and can be bought and sold at a price set by the market—each with people making predictions for the future value of the stock.

At face value, comparing prediction markets to equities is kind of insane—equities tend to map to companies which tend to produce tangible value. Prediction markets map to future outcomes which produce no tangible value outside of the market price itself (a valuable signal), but that value production is an output and not captured. At the end of a prediction market, the winners are left with the money and the losers are left with losses. In equities, the winners walk away with the money and no one is left with any losses (unless you decided to explicitly short the company).

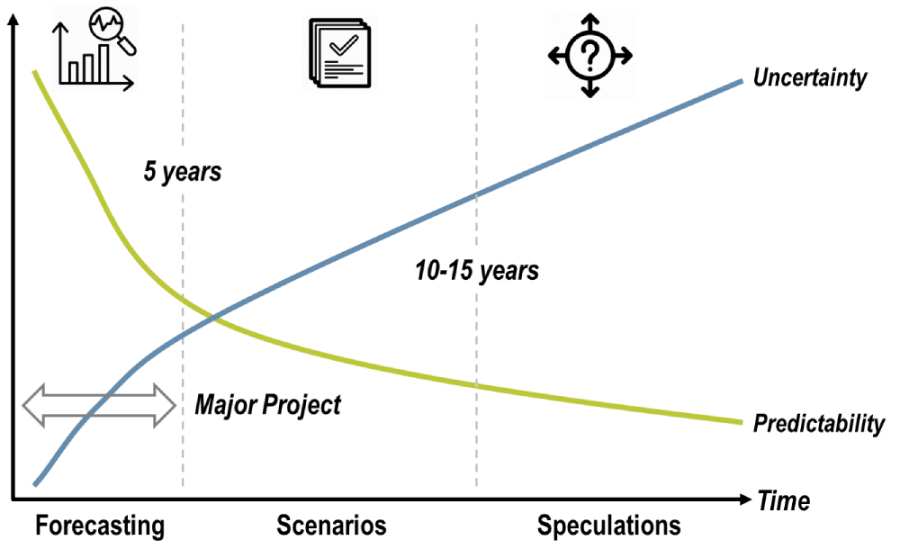

Prediction markets are useful: they can be an accurate tool to tell us the likelihood of any given event. More of these markets would mean more ability to get society's best guess for any given event—however small or bespoke. if we could find a positive sum construct of prediction markets, that may offer a path to seeing more of these being created. So what could this look like?

Forward facing Provenance

Using NFTs to predict the future.

Using NFTs to predict the future.

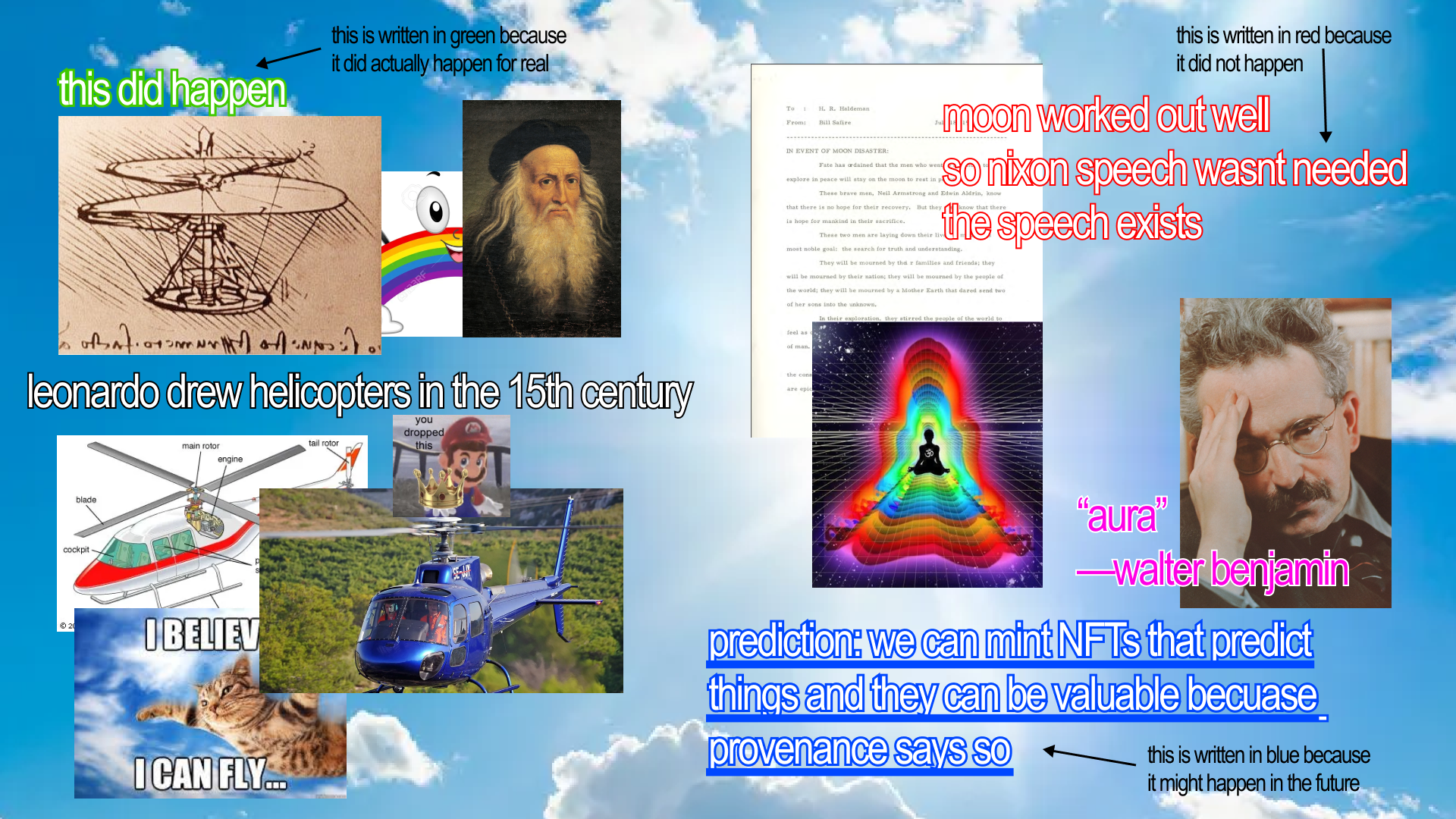

NFTs are interesting because in some sense they can create equity in a moment. One way to think about this via Art. A painting is part the work itself and part the provenance and moment it was created in (“Aura”). At least some of the value of the work is derived from the moment it was a part of. Let’s imagine that an artist wants to make a prediction that aliens will publicly visit humanity for the first time on December 1st, 2025. They even go as far as to say that they will hover above the Eiffel Tower.

This is an extremely out there bet. The artist may want 1 million to 1 odds. They might be able to find a bookmaker who will offer them 5000:1, perhaps 10,000:1 as is common for novelty bets on popular events. But this will take a lot of work, and it will require the artist to put forward some money which will be locked up for a couple of years. The artist would bet everything if they could, but they can’t afford it, and if they could they probably couldn’t anyway.

The artist then has an idea: they will paint that precise prediction. An alien spacecraft hovering over the beautiful Eiffel Tower at night time, with some artistic license to add a clock and calendar somewhere in the image to make the date prediction. Not only will they paint it, they paint 10 of them, and go to a journalist to write a small piece to timestamp and authenticate the time of the creation and the artworks themselves. The journalist buys one of the editions from the artist for $100 because they find it amusing and happen to like the art, and one reader feels the same buys one for the same price. In the meantime, they are locked in storage.

Fast forward to December 1st, 2025 and against all odds—the Oumuamua craft hovers over the Eiffel tower as it lights up at midnight, thousands live stream it and low and behold: aliens have publicly visited humanity for the first time.

Oumuamua over Paris at Midnight, by Mat Dryhurst

Oumuamua over Paris at Midnight, by Mat Dryhurst

Question: how much are these paintings worth?

Are these paintings worth $100? Perhaps $10,000 each? Maybe more? It’s hard to imagine a case where they are the same price or cheaper—but admittedly it is hard to say how much they would be worth. If they are selling for more, then the artist has effectively created an object that represents ownership over that prediction, and has been able to capture value as a result without having to find a counterparty. They have created equity in a moment—aka positive sum prediction market.

So now let's imagine instead of the artist painting physical works, they simply minted it as an NFT—not because we like NFTs (we may or may not), but because we get all of the functionality that the artist had at lower cost and effort. By minting as an NFT this means that they get the time stamping functionality out of the box (impossible to fake), visible to the entire public (by nature of being on the blockchain) and also happens to be tradable before and after the fact. We find ourselves in a position where people are able to essentially create positive sum prediction markets for anything.

If we are to use the art term, we’ve essentially created speculative provenance markets. Art created with the specific intention of capturing forward facing provenance.

You could imagine in more common predictions, people may go searching for NFTs that align with their predictions and buy and sell them on the open market.

Making predictions.

Making predictions.

You could also imagine entities specializing in creating standardized prediction NFTs, and even playing around with the artistic aesthetics of them as a variable for their success and marketability as prediction objects. Great looking art may be a great consolation prize in the case that the prediction turns out to be wrong—perhaps Atlanta Falcons fans would be holding some artworks illustrating the world where Tom Brady didn’t pull off the greatest Superbowl comeback of all time.

Even more interestingly, what does it mean when predictions become positive sum with that level of granularity? Do more people start working together to make something a reality? Or stop something from happening? Who knows.

Well, I guess there may be a way to find out :~) Let’s run the experiment now: here is an NFT of an artwork that predicts that this format will work sometime in the future. Let’s see what happens.

View on Zora.

Thank you to Corrine Ciani for editing.

❍ 2022 jacob